In recent years, the landscape of investment has evolved beyond a sole focus on financial returns. Among the many companies embracing ESG principles (Environmental, Social, and Governance), one standout example is Worthington Industries. An interesting fact about the company: in 1955, the founder McConnell purchased his first load of steel by borrowing $600 against his 1952 Oldsmobile. Today, the global headquarters houses a replica of the car, serving as a reminder of the company’s story.

Anyway, you might be confused about what ESG truly means and how it relates to the investment world. In this article, let’s delve into the key components that define ESG and how companies like Worthington Industries are shaping a more responsible and sustainable future. Perhaps you’ll want to incorporate this approach into your trading journey on Binomo.

What is ESG and examples?

ESG, which stands for Environmental, Social, and Governance, is a set of criteria used by socially conscious investors and hedge funds. The criteria is used to evaluate and screen potential investments based on a company’s behavior and practices in these three areas. This goes beyond traditional financial metrics and takes into account a company’s broader impact.

ESG investing is often referred to by various names, such as sustainable investing, responsible investing, impact investing, or socially responsible investing (SRI). The underlying principle remains the same: investors seek to support companies that align with their values and contribute positively to society and the environment.

A global technology leader, Microsoft, for example, is renowned for its ambitious goal in 2020 to become carbon negative by 2030 (Environmental Sustainability Vision) program. Accenture, a management consulting company, introduced a Diversity & Inclusion 360 initiative, which has already yielded a 20% increase in shareholder value.

The three pillars of ESG: environment, social, and governance

At the heart of this transformation lie three critical pillars for responsible investing:

Environment: evaluating a company’s environmental impact

The environmental pillar focuses on understanding how a company’s activities impact the natural environment and its overall contribution to climate change and ecological degradation. Key factors:

- Greenhouse gas emissions, with a focus on reducing their carbon footprint

- Use and management of natural resources, including water and raw materials

- Pollution levels and how they handle waste disposal

- Response to climate change and their strategies for adaptation and mitigation

- Fossil fuel usage

- Proper handling and disposal of hazardous materials

For certain industries like chemical, energy, and utilities, environmental considerations carry even greater significance due to their potential for impact on the environment.

Social: assessing a company’s social impact

The social pillar evaluates how a company’s behavior impacts its employees, customers, supply chain partners, and society as a whole. It covers a range of social issues, including:

- Efforts to promote employment equality, gender diversity, and inclusivity

- How they ensure the safety and quality of their products and services, as well as how they handle liabilities

- Measures to protect employee health and safety in the workplace

- Commitment to human rights, fair labor practices, and transparency in their supply chain

- Stances on issues related to physical and mental health, drug abuse, gambling, and reproductive choice

- How a company handles customer data and privacy

Governance: analyzing corporate governance structure

The governance pillar focuses on a company’s internal operations and corporate behavior. Key considerations:

- How a company compensates its employees and board executives, as well as the level of diversity within the board and the organization

- Tax strategies and adherence to accounting standards

- Corporate ethics and adherence to ethical principles

- The level of transparency and measures taken to prevent corruption and unethical practices

- The extent to which shareholders’ rights and interests

A history of bribery, fraud, or corruption points to a riskier investment.

The link between ESG factors and financial performance

By incorporating ESG criteria, investors can identify companies that are not only financially robust but also better equipped to address future risks and seize opportunities related to ESG issues. The current consensus is that businesses that prioritize sustainability and social responsibility are more likely to demonstrate resilience and adaptability in the face of changing market dynamics and regulatory landscapes.

Also, the integration of ESG factors helps investors gain a more comprehensive understanding of a company’s overall risk profile. The assessment of a company’s environmental impact, social practices, and governance structure may uncover potential risks and opportunities that might not be apparent through traditional financial analysis alone.

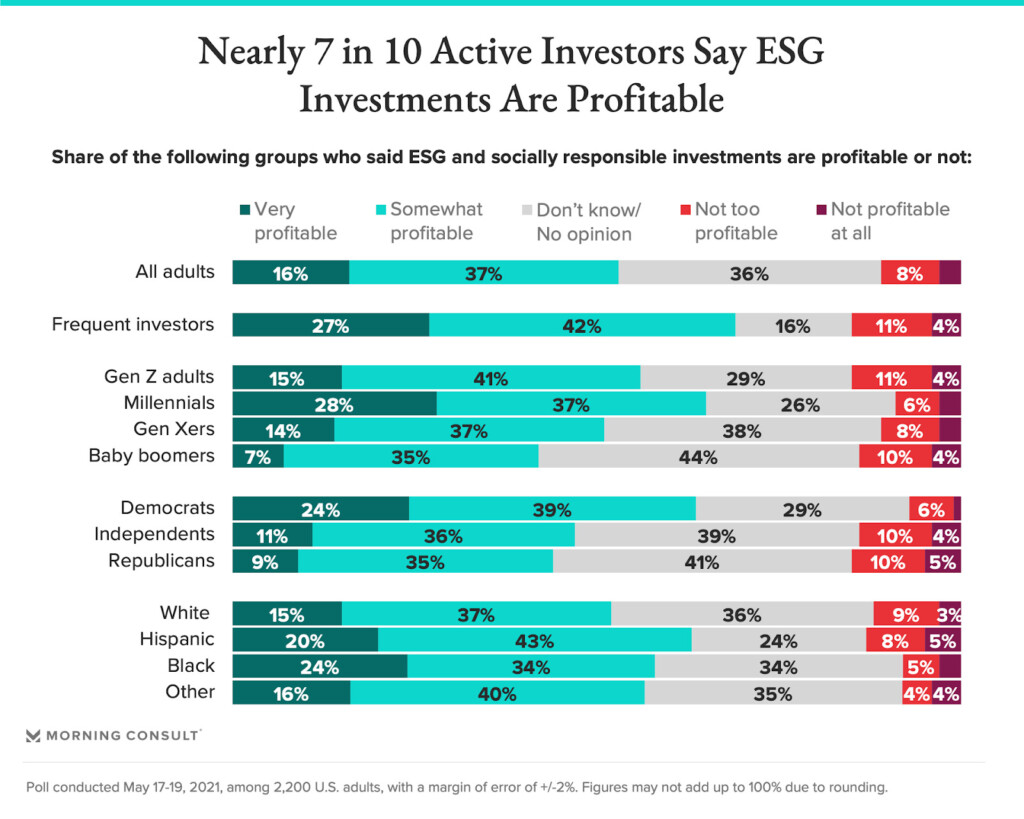

Besides, the growing body of empirical evidence suggests that companies with strong ESG performance tend to outperform their peers over the long term (according to Morning Consult). So, let’s get in on the action!

ESG investing strategies

When crafting an ESG investing strategy, consider these approaches:

- Exclusionary screening — Excluding companies or sectors that exhibit poor ESG performance or are involved in controversial activities from the investment portfolio.

- Best-in-class selection — Identifying companies within their respective industries that exhibit superior ESG performance.

- Thematic investing — Centering on specific sectors, industries, or themes that demonstrate strong ESG characteristics.

- Impact investing — Targeting opportunities that generate measurable environmental, social, or governance benefits alongside financial returns.

- Active ownership — Engaging with companies to encourage improved ESG performance and practices. You can achieve this through voting on shareholder resolutions, participating in collaborative engagements, or directly engaging with company management.

Remember that you have the flexibility to pick and choose elements from various investing approaches and tailor your strategy to align with your unique values, risk tolerance, and financial goals.

Challenges and criticisms of ESG investing

Incorporating ESG-factor data into the investment process is complex and resource-intensive. For instance, investors face challenges in accessing reliable and standardized data. This is because ESG data is sourced from multiple providers with varying methodologies, and it’s hard to make comparisons between companies and industries.

Another criticism is the potential for greenwashing. It’s a practice of companies making misleading or exaggerated claims about their environmental or social efforts to appear better than they truly are. As a retail investor, you never really know the truth.

Also, ESG factors can be influenced by political and social perspectives. Different investors may have varying criteria for what constitutes positive ESG performance, which ultimately leads to discrepancies in ratings and interpretations. And finally, the full extent of ESG integration’s impact on financial performance is a subject of ongoing research and debate.

The future of ESG investing

The transition from ESG 2.0 to ESG 3.0 is on the way. ESG 2.0 is about growing awareness of the financial implications of poor ESG performance. However, ESG 3.0 takes it a step further by actively causing impact through three key metrics: potential avoided emissions, time value of carbon, and carbon returns.

The first one is a metric calculating emissions prevented by existing solutions compared to alternatives. The second one is about acting now to prevent emissions, which is deemed more impactful than doing so in the future. And the third one is about preventing high emissions per dollar invested. Together, ESG 3.0 signifies a shift towards actively driving impact through capital allocation.

If you decide to use ESG metrics in your strategy, make sure to use them in combination with other trading tools on Binomo!

Sources:

ESG investing: meaning and trends, Greenly Institute

The evolution of ESG investing, MSCI

The rise of ESG 3.0: How the future of ESG can deliver better results, NASDAQ