By studying the stories of Forex traders, one can see that no more than 5% of traders manage to stay on the market from year to year, consistently earning. The reason is simple: most traders have poor money management. Here are 5 useful tips that can help you become among the successful 5% of traders.

1. Never try to recoup after lost deals

There is an opinion among traders that it is impossible to predict the direction of price changes. They believe it’s easier to trade on the principle of “one profitable trade covers previous unprofitable ones.” This principle is known as the Martingale strategy.

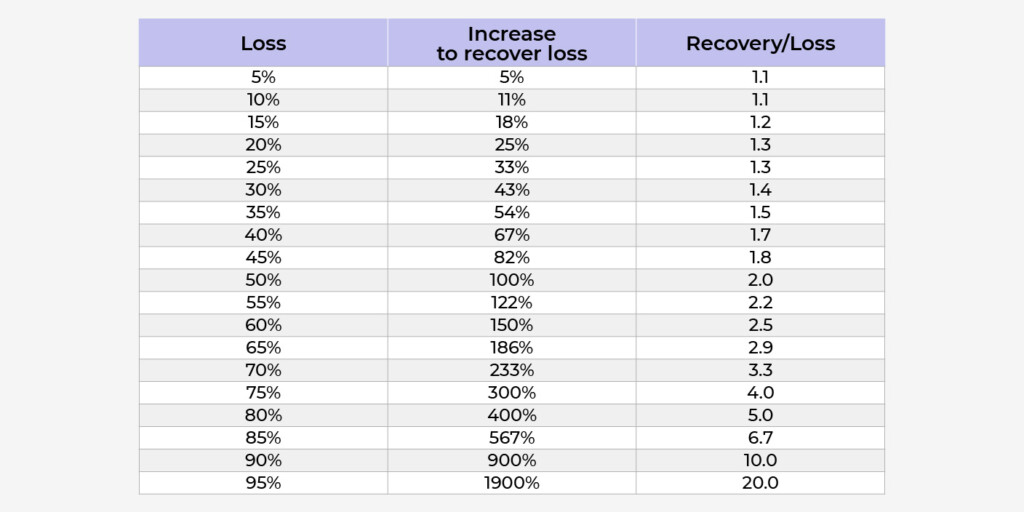

This table shows how much one trade should bring to cover all previous losing trades. For example, one will need to make returns of 54% of the current balance to recover a deposit after losing 35% of the initial amount.

As you can see, the risks are too high, which is why you shouldn’t recoup.

2. The average return should always exceed the average loss

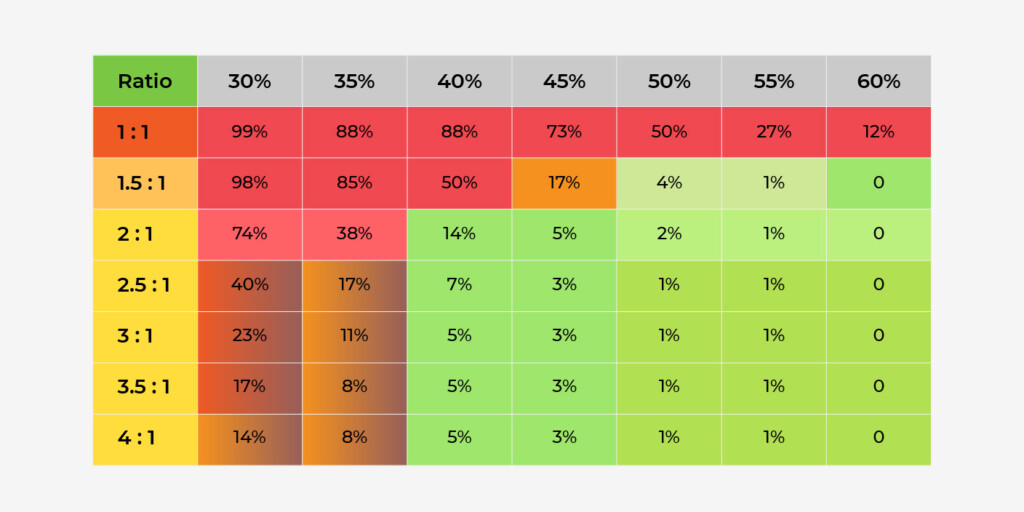

Even the most profitable system does not guarantee that all transactions will be successful. The following table shows the probability of losing a deposit in a series of losing trades:

- Ratio column – the ratio of profit to risk (or take-profit to stop-loss)

- Percentages on a gray background – the share of successful trades

- At their intersection – the theoretical probability of a deposit drain is shown

Trading strategies falling on light sectors can be considered conditionally breakeven: they may be rather stable. By the way, even if the share of successful trades is less than 50%, the strategy can be quite reliable if the returns exceed the risks by several times.

The higher the ratio of take-profit to stop-loss, the lower the probability of closing a trade with a return. However, a good strategy has an optimal ratio of returns and loss. There are several ways to achieve this goal:

- Set take-profit always higher than stop-loss

- Choose a trading strategy that focuses on successful trades

- Combine both of the above approaches

3. Never change the rules after the trade is opened

Sometimes, successful trades are closed by stop-loss, and failed trades are closed by take-profit. Such cases can occur when using a trailing stop or when a trader gives in to emotions and interferes with a trading strategy. So, having chosen your strategy, do not interfere in its work, no matter where the price goes. Limit the maximum losses to avoid large drawdowns of the deposit.

Warren Buffett says “Your risk in one trade should never exceed 2% of the capital.”

There are two options here:

- A big lot and short stops

- A small lot and long stops

The latter is more reliable: long stops won’t be knocked out with a light price volatility.

4. Set a stop-loss at once, don’t postpone it until later

Even the most reliable Internet providers cannot guarantee a stable connection. There’s always a risk that if the Internet is accidentally disconnected, the price will go too far into the loss zone, and the trader will not be able to close the deal. Therefore, set a stop-loss and take-profit at once when opening a deal.

5. Succeed in a demo account before using real funds

If you are unsure of your strategy, try it out on a demo account. There is a lot of software to optimize almost any strategy. Once you’ve worked out any kinks, it’s time to test the new parameters in practice. It’s better to lose a few months on a demo than to spend all of your capital on a real account.

Conclusion

It seems to be simple to follow just a few basic principles of money management. But therein lies the trap: most novice traders are in a hurry to succeed quickly, violating the basic rules. However, it is worth being patient and disciplined for at least 5 years to see results.

Sources:

Money Management: Definition and Top Money Managers by Assets, Investopedia

Forex: Money Management Matters, Investopedia