Exotic currency pairs — the name alone sounds intriguing, and rightly so. Not everyone will be willing to take on the challenge of trading them, but these currency pairs certainly offer unique opportunities.

And speaking of unique opportunities, did you know that the Central Bank of the Republic of Turkey once issued a series of banknotes featuring characters from Turkey’s popular TV series The Magnificent Century? That’s an exotic interpretation of the currency.

If you’re interested in learning more about exotic currency pairs, including its definition, examples, tips, and strategies for trading them, be sure to read the guide.

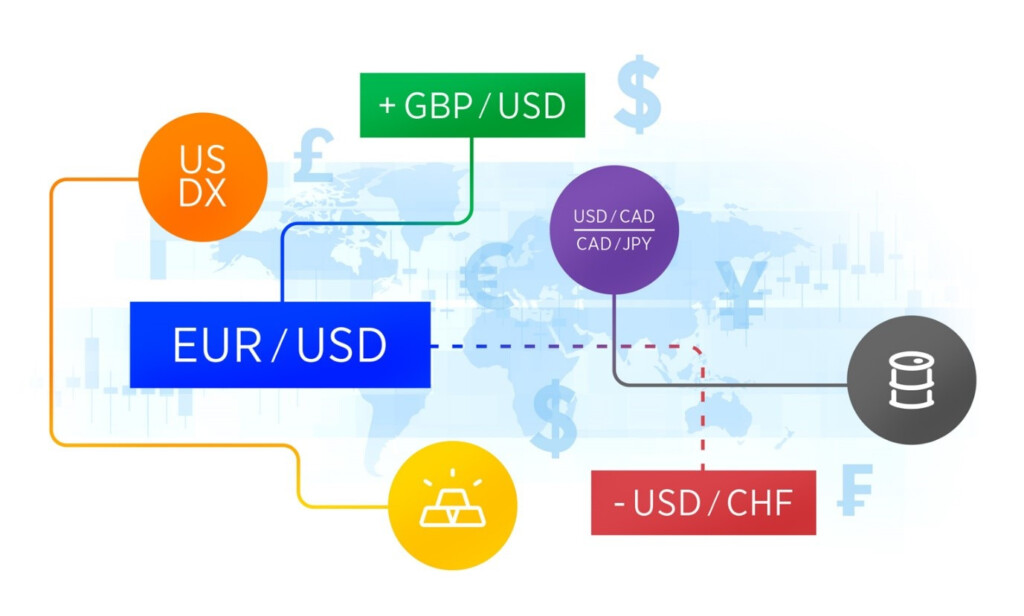

Types of currency pairs

There are three main types of currency pairs, and each type has its own unique characteristics and advantages.

Major

Major currency pairs are the most heavily traded in the forex market and account for about 80% of all trading volume. The majors often include the US dollar (USD) paired with currencies from the world”s largest economies, including:

- Euro (EUR)

- Japanese Yen (JPY)

- British Pound (GBP)

- Swiss Franc (CHF)

- Canadian Dollar (CAD)

- Australian Dollar (AUD)

Major pairs are the most liquid and offer the lowest trading costs.

Minor

These pairs are also known as Crosses or Cross currency pairs. They consist of currencies that are not the US dollar but are still considered significant in the global economy. For example:

- Euro/Japanese Yen (EUR/JPY)

- British Pound/Swiss Franc (GBP/CHF)

- Australian Dollar/Canadian Dollar (AUD/CAD)

Minor currency pairs are less liquid than major pairs; still, they’re fairly popular even during times of market volatility.

Exotic

Exotic pairs are composed of currencies from smaller or emerging economies, whose currencies are not commonly traded in forex. Due to their lower trading volumes, they tend to have higher trading costs compared to major and minor currency pairs. They are also more prone to experience sharp and sudden fluctuations.

That said, exotic pairs open up options to diversify a trader portfolio and take advantage of market inefficiencies.

Anatomy of an exotic currency pair

Exotic currency pairs typically involve at least one lesser-known currency, such as the Thai baht or the Indonesian rupiah. But the pair doesn’t have to involve only lesser-known currencies.

In fact, it can also involve major currencies like the US dollar or the euro. What makes an exotic currency pair is the fact that it involves a currency that is not widely traded or used in international transactions. For example, the EUR/HUF pair involves the euro, which is a major currency, and the Hungarian forint, which is not.

Most popular exotic currency pairs

Forex exotic pairs don’t get a lot of attention, but some have become increasingly popular among traders:

- Euro/Turkish Lira (EUR/TRY)

- Singapore Dollar/South African Rand (SGD/ZAR)

- Brazilian Real/Turkish Lira (BRL/TRY)

- Singapore Dollar/Mexican Peso (SGD/MXN)

- Chinese Yuan/Russian Ruble (CNH/RUB)

- Euro/South African Rand (EUR/ZAR)

- British Pound/Russian Ruble (GBP/RUB)

- Euro/Mexican Peso (EUR/MXN)

- Mexican Peso/South African Rand (MXN/ZAR)

While there are many other examples that you can explore, the general idea is the same: currencies from smaller, less established economies.

Tips for exotic currency trading

“When trading exotic currency pairs, it’s important to pay close attention to geopolitical events and economic data releases that can have a significant impact on the currency’s value.”

Raghee Horner, author of Forex Trading for Maximum Profit

As you can already tell, trading exotic currency pairs can be tricky. But to help you navigate the market better, here are a few tips to keep in mind:

- Exotic pairs carry an increased risk due to their high volatility. Therefore, it’s crucial to have a solid risk management plan in place and be prepared for potential losses.

- Another key consideration is liquidity, so finding a buyer or seller may not be easy. Therefore, you should monitor liquidity levels and adjust your trading strategy to avoid missed opportunities or difficulties in exiting a position.

- Lastly, you should be aware of the lack of available information on exotic currencies. When conducting thorough research and analysis, you’ll be dealing with fewer resources to draw upon. But relevant news sources, government publications, and economic data releases are still out there.

Exotic currency pairs can be challenging, so many traders tend to favor reliable trading strategies when dealing with exotic pairs. Here are three effective ones:

1. Breakout trading strategy

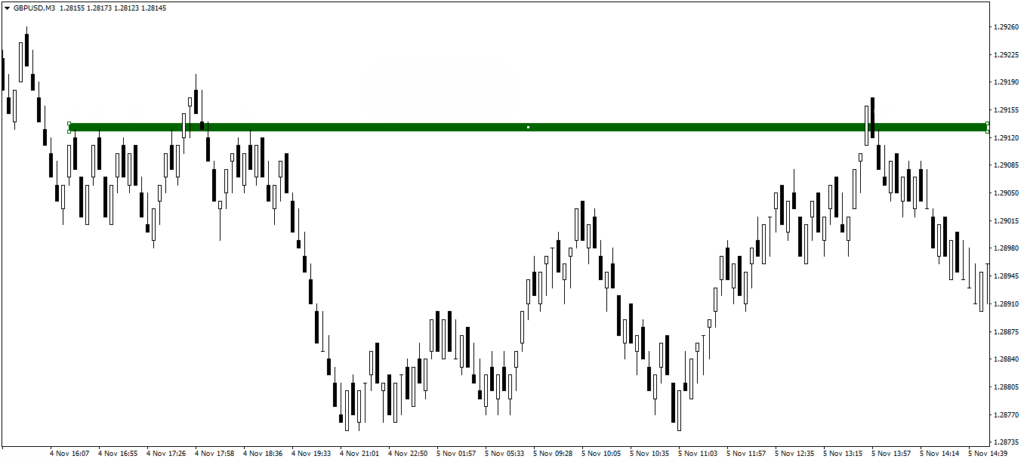

To trade the breakout strategy, you’ll need to combine both technical and fundamental analysis. Your goal is to identify significant levels of support and resistance and wait patiently for a break in either direction. Once a breakout occurs, you may have the chance to capture significant profits by riding the momentum of the move.

To find potential breakout opportunities, you’ll want to look for chart patterns like ascending and descending triangles, pennants, and wedges. These patterns often occur when the price is consolidating within a narrow range and signifies indecision in the market. And they can suggest in which direction the market may move next. However, it’s important for you to keep in mind the risk of false breakouts.

2. Range trading strategy

Range trading involves identifying a range between support and resistance levels. And here, the goal is to profit from the peaks and troughs within this range by going long or short as the price moves towards the upper or lower boundaries of the range, respectively. In other words, buy when the price is near support and sell when it is near resistance.

One of the key advantages of range trading is that it’s considered a relatively low-risk strategy. This is particularly useful when trading exotic currency pairs, which aren’t known for minimizing trading risk.

When range trading, you’re also interested in chart patterns. But the focus is slightly different — you’re looking to profit from smaller predictable movements of an exotic currency pair.

3. Trend trading strategy

Trend trading will be a particularly attractive strategy for traders who prefer to follow the momentum over trying to predict sudden price movements. With this strategy, you’ll be trying to identify the trend of a pair and capitalize on the direction of its movement over a longer period of time.

One of the key benefits of trend trading is its simplicity. Instead of trying to analyze complex market conditions, you’re only focusing on the direction of the existing trend. This makes it a more accessible strategy for beginner traders.

Pros and cons of trading exotic pairs

“Exotic currency pairs are generally more volatile and less liquid than major currency pairs, making them more challenging to trade. However, for experienced traders, these currency pairs can offer unique opportunities for profit due to their potential for large price swings.”

Kathy Lien, author of Day Trading and Swing Trading the Currency Market

Pros:

- Lower correlation with other financial instruments compared to stocks and bonds.

- Exotic pairs are less affected by macroeconomic forces, which creates valuable diversification opportunities for traders.

- Higher potential for profit due to high volatility.

Cons:

- The lack of market liquidity makes it challenging to buy or sell at preferred prices.

- With larger price movements, traders may need to allocate more capital to trade exotic pairs effectively.

- Higher volatility may mean more significant losses, especially if traders don’t have a robust risk management plan in place.

- The risk of currency devaluation is higher for exotic pairs.

Conclusion

Exotic currency pairs may seem intimidating at first, but they don’t have to be an obstacle for forex traders willing to take on additional risk. Such currencies can experience significant price movements due to economic and political events in their respective countries. But you just need to know how to approach them the right way.

Focus on gaining a solid understanding of the underlying fundamentals, risk management, and proper portfolio diversification. Also, be sure to follow the tips listed above and look into breakout, range, and trend trading strategies.

Sources:

Exotic Currency Pairs: Examples, Risks and Strategies, Day Trade The World

How to Take Advantage of The Breakout Trading Strategy, The5ers

Forex: Should You Be Trading Trend or Range? Investopedia