In the following article, we will discuss everything about selling shares, such as how to decide when to sell a stock for a profit. We will also answer FAQs from investors and traders, like when to get out of a stock, how to book profits in shares, and explore common buy-and-sell problems.

Selling a stock is hard

The capacity to get additional income from stocks ultimately relies on two crucial choices: purchasing at the right moment and selling at the appropriate time. You must perfectly carry out both of these actions to earn extra income.

The choice to sell a stock is typically more challenging than purchasing it. You risk passing up rewards if you sell the stock too soon and it rises. If you sell too soon and the stock goes down, you most likely lose your opportunity to get additional income.

When it comes to selling stock, here is a common scenario any investor can go through. He decides to purchase shares at $25 to sell them for $30. When the stock reaches $30, he chooses to wait for another few dollars of extra income. When the market reaches $32 for that stock, greed triumphs over logic. The stock price abruptly reverts to $29. The investor advises himself to wait till it gets $30 once more. But this never takes place. When the stock price reaches $23, he eventually gives up in despair and sells at a deficit.

In this situation, passion and greed have triumphed over reason. Although the investor only lost $2 per share, when the price peaked, he could have gotten $7.

The core question is why investor sells or not, and it could be wiser to disregard such paper losses rather than obsess over them. You can consider setting a limit order that will mechanically liquidate the stock once it hits the target price point to eliminate human psychology in the future. You won’t even be required to observe the price of that stock fluctuate. When the sell order is made, you’ll receive a notification.

When should you sell?

Generally, there are a few extrinsic motives for stock sales, including ones about the markets or the shares. In addition, investors could be motivated to sell for external reasons, which may be related to their wealth or way of life. Sometimes, a mix of internal and external variables may lead to the selling decisions. Let’s take a closer look at all these factors below.

Intrinsic reasons to sell

If you are wondering when to sell my shares, here are a few scenarios suitable for this:

- When the price increases significantly: It’s not always a good idea to sell a stock just because its value has increased dramatically. In certain situations, the firm’s fundamentals could support the price increases (for instance, if revenues or sales are growing more quickly than anticipated by investors). In other cases, however, the price can have seen substantial growth only due to speculation or other causes, like a short squeeze or takeover speculations. In these situations, the shareholder would be advised to investigate the cause of the company’s earnings. Next, according to the results, the investor can either sell the entire position or its portions and enact a stop order to dispose of the remaining portion if it falls below a certain premium.

The choice to dispose of a stock becomes more important as its recent income adds to your entire portfolio. For instance, if you purchased 2000 shares of a business for $6 per share when the total value of your investment is $35.000, that stock would have made up 34% of your holdings. If the company doubled on promising trial findings a few months later and the remainder of your investment remained the same, it would make up 68% of your investment. Due to the potential harm to the portfolio, it could be wise to dispose of a few of the shares. This way, you could take a portion of the income if the stock reversed its rise.

- When the first purchase choice was incorrect: Most seasoned investors and traders have probably encountered this circumstance at some moment. You’ve seen stock, or more likely, a meme stock, soar to such heights every day that you eventually decide to dismiss your skepticism and impulsively place a sizeable purchase order. However, as soon as you do, you recognize that you probably miscalculated. Selling the stock may seem the most brilliant move in this situation, even if doing so results in a slight loss on the deal. Avoid the urge to follow hot stocks operating on fumes since doing so might cost you funds.

- As soon as stock hits the price objective: Have you ever held a stock that has been at the bottom of the market for years but suddenly starts trading at your original entry price? If you have previously decided to sell the stock, if it ever returned to your purchase price, do it immediately (although you should never have been clinging to it for such a prolonged period).

Likewise, why don’t you sell the entirety of a stock once it hits the level it traded too briefly in the past, and you always intended to sell if it reaches that price again? Keep reading to find out.

- Whenever a stock is trading at a technical turning moment: When a stock trades close to and then falls under a Multiyear Bottom, it frequently foreshadows further losses coming in the future. When the technical level is broken down, it could be wise to sell the stock immediately. It may also indicate other profits and a more comprehensive sell range for a company if a stock crosses over a significant resistance line on the upside. In this case, it could be better to sell some of the position instead of all. Also, technical analysts pay great attention to the price movements of stocks to spot other indicators like moving average crossings.

- Deterioration of the fundamentals of stock: It could occur due to various factors, including lower profits or sales growth, heightened competition, more expenses, and lower margins or prices. A firm’s monthly earnings report or occasionally “guidance” given before a financial report can be the first indication of worsening fundamentals.

When a firm releases bad news, like missed profits or reduced future outlook, the market often reacts quickly and unequivocally, and the stock is most likely to fall by double figures. In these situations, the investor must decide whether the stock’s fundamentals have temporarily or permanently deteriorated. This is not a simple undertaking. Therefore it could be better to sell and get out of the position first before deciding one should repurchase it in the future.

- When a competing firm releases negative news: Frequently, when a leading firm in that area produces profits below expectations, the concerns impacting that category could be brought to light. If you’re not sure that the sector’s problems won’t affect your stock, you should consider selling any shares you may hold in a firm in that industry.

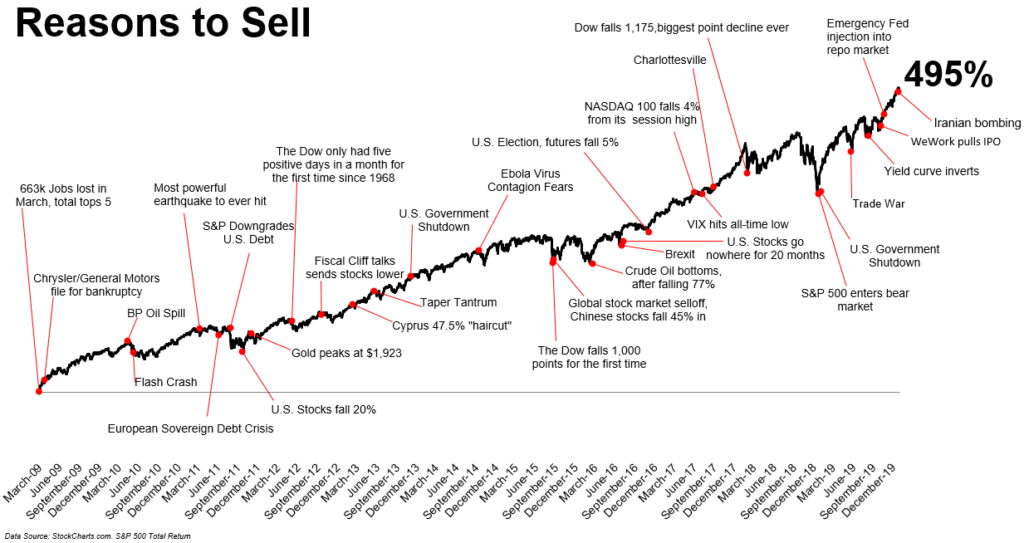

- When the market appears shaky: There are occasions when the whole market seems to be overextended; during such periods, it stands to reason to trim the weakest firms in your portfolio. Stocks of corporations with high debt loads or precarious financial positions may be among the first to decline during one economic earthquake. However, this is no simple task, and it is not a recommendation to engage in timing the market.

Next, we will examine the main external factors that may indicate the best time to sell stocks.

Extrinsic reasons to sell

There are only two main extrinsic factors for excluding shares from your portfolio:

- Lifestyle factors. Changes in the way of life might be an important cause of selling stocks. Younger investors may think about liquidating the entire or a portion of their holdings to put a deposit on a house or automobile.

Investors close to retirement may sell shares to wind down their portion of their investment portfolios and lower their risk exposure. Additionally, parents may sell assets to receive tax credits for specific goals, including their kids’ schooling.

- Financial reasons include a vast number of factors related to the investor’s capital. For example, a stock could have increased substantially compared to the remainder of the portfolio, and the investor may have to rebalance it to get the portfolio back on track. Another option is to sell a stock to record a deficit for taxation.

The reason for selling stock could also be that the investor needs the capital for buying property or other purposes.

Combination of reasons

A mix of extrinsic and intrinsic variables may occasionally prompt the decision to dispose of a stock or group of shares. Imagine, for instance, that you lost your employment due to a business restructure and are just a few years away from retiring. You have been concerned about the higher levels and record high values of the markets, but you haven’t felt motivated to take action. However, you may now decide to hold onto your capital to invest it in the company you’ve always wanted to launch. Thus, your decision to sell is justified by both internal factors (dramatic lifestyle change) and external factors (markets’ elevated valuations).

If the share price plunges, should I sell it or buy more to average down?

This solution truly relies on several, including the risk appetite, type of stock, investing goals, available cash, etc. Selling can be a good idea if the stock is speculative and falling due to a long-term shift in its forecast. Averaging downward is a tactic that is worthwhile to think about if the stock in question is a blue chip and has seen a momentary setback.

I like the long-term prospects for stock in my portfolio, but I am nervous that it might fall in the short term. Is there an alternative to protect my downside instead of selling it?

Think about a put option that gives you the authority to sell a stock for a specified time at a specified rate. However, note that both insurance and put options are expensive.

Can I sell a stock the same day I bought it?

Yes, as long as you don’t do it too often. If not, you can be categorized as a day trader. Day trading should only be done by knowledgeable, well-capitalized investors because it can lead to significant losses.

When I sell a stock, after how many days will I receive the proceeds?

The T+2 settlement period is the usual time for receiving stock sale income; it is two days long for most equities.

General

We hope this article cleared up common questions about when to book profits in stocks and whether your shares can be sold at any time.

Whether you are trading in the UK or any other country, understanding when to sell shares can help you avoid potential losses. However, before making any decision in the trading world, always think twice, as one wrong move can cost you capital.