According to Trivers’s theory of self-deception, self-deception is good for us, as it’s supposed to orient us favourably toward the future. When it comes to trading, you will frequently convince yourself that your trading decisions are logical, even in instances where you lose. It’s not hard to see how this self-deception can put you in a feedback loop, captive to your psyche constantly repeating the same mistakes over and over.

And the first step towards breaking out of this pattern is to recognise them. Here are five psychological quirks that affect your trading.

Bandwagon effect

In behavioural finance, the bandwagon effect is the drive to invest in particular assets or open specific positions just because others are doing it. It arises from herd mentality – it is a psychological need to always jump in on what other traders are doing. And that often drives you to abandon your trading plan and open positions without proper analysis. It is popularly referred to as FOMO (fear of missing out).

As Richard Branson said, “…opportunities are like buses, there’s always another one coming…”.

The same goes for trading opportunities, if you missed out on one, there will be more – after all, the market isn’t going anywhere. The best way to beat the bandwagon effect is to remember that trading should be personalised and logical. It should take a personalised approach based on your capital and financial goals – being consciously aware that what works for others may not necessarily work for you. And it should also be logical, having a clear trading plan.

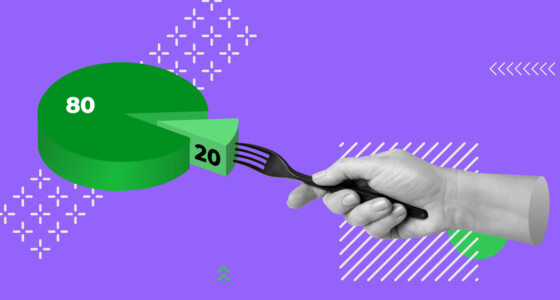

Loss aversion

In the context of behavioural finance, loss aversion doesn’t mean that traders and investors prefer to completely avoid losses. As every trader knows that losses are inevitable. However, loss aversion is a heightened psychological desire to avoid any perceived risk that may result in losses.

And despite the knowledge that losses are inevitable, most traders tend to be crippled by the fear of a loss. This concept is perhaps popularised as FUD (fear, uncertainty, and doubt) in crypto trading. And consequently, may lead to premature exits resulting in loss of potential gains, or incurring avoidable losses.

Revenge trading

It goes without saying that no one likes losing; and when losses are incurred, our psychological instinct is to recoup as soon as possible. And this often leads to revenge trading – attempting to profit after a significant loss by ploughing back more money into a losing strategy or asset.

Revenge trading can also be linked back to belief perseverance, and this often leads to the sunk cost fallacy. It hinges on the idea that since you’ve already incurred losses, and you believe your analysis, you’re driven to stick with the trade. In the end, you spend more to continue chasing a losing trade – trading plan and risk management be damned.

Confirmation bias

According to cognitive scientists, we have a natural tendency to look only for corroboration. We tend to only pay attention to information that confirms our beliefs and perceptions and disregard those that contradict us. This is the confirmation bias.

In trading, confirmation bias misleads us to only factor in positive information regarding our trading decisions. This may inadvertently lead to overconfidence resulting in taking higher risks. Confirmation bias is intertwined with belief perseverance.

Belief perseverance

This is the tendency not to reverse one’s opinions even when you receive new pieces of information that prove your initial position to be wrong. For example, let’s say you’ve already made up your mind about trading shorting a particular asset or investing in a given asset. You’ll subconsciously find it’s almost impossible to alter your decision even when you find reliable information that contradicts you.

Belief perseverance can be attributed to the law of consistency. In this case, traders develop stubbornness and stick to their past trading patterns as a precedent for the future. And based on Trivers’s theory of self-deception, we have emotional attachments to beliefs, which in some cases may be irrational.

As Nassim Nicholas Taleb, the author of the best-selling book ‘The Black Swan,’ puts it, “… we treat ideas like possessions, and it will be hard for us to part with them.”

Conclusion

There’s no denying that psychology and trading go hand-in-hand. Obviously, a lot of factors go into ensuring that you are consistently profitable in the long run. However, it’s painfully clear that traders can be driven by their subconscious, all the while convincing themselves that they are making the best possible logical trading decisions. And this can curtail any prospects of long-term profitability.

In this case, the first line of defence is recognising the problem; and that’s why we’ve reviewed five psychological quirks that affect your trading.